Qualco Group S.A.: Half-Year Financial Results H1 2025

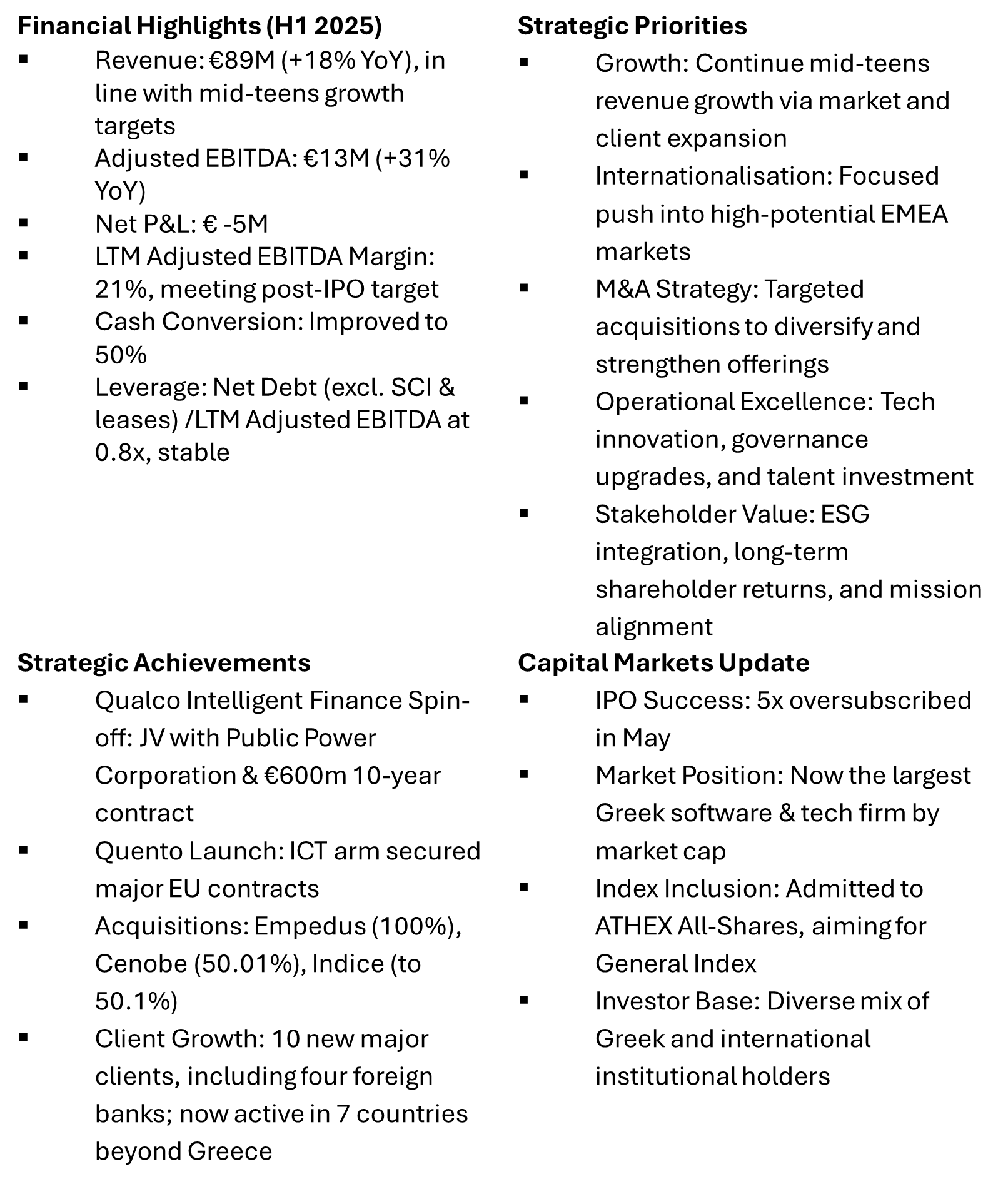

Following our successful IPO in May, we had a solid performance during the first half of 2025. H1 2025 results demonstrate strong, disciplined execution against our strategic objectives and confirm Qualco Group’s well-positioned position to deliver our medium-term guidance. As we advance through the remainder of 2025, we remain committed to executing our strategic roadmap while maintaining the operational discipline and governance standards that have defined our success.

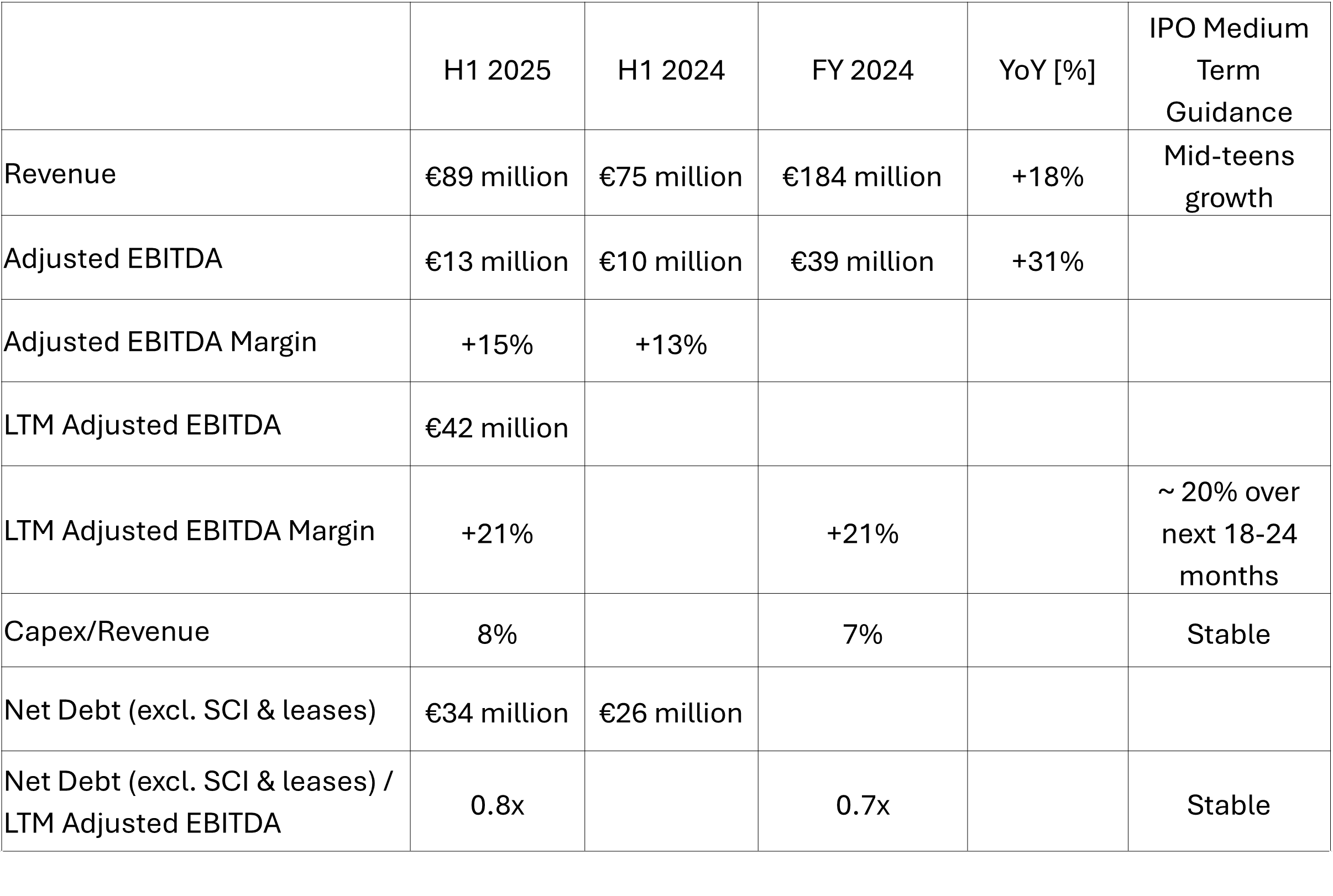

For H1 2025, Qualco Group accomplished an 18% YoY revenue growth and a 31% YoY growth in Adjusted EBITDA. In terms of net profitability, excluding adjustments, we incurred a loss for the first half of 2025. The negative bottom line is mainly attributable to reorganizational expenses, which include legal and consulting services to transition the mother company from English to Greek jurisdiction and prepare the Group for its successful IPO and rationalisation of the Group’s structure. The amount of these reorganizational expenses was also due to the limited timeframe for this preparation. They are truly non-recurring (one-off) expenses that are now complete and will not impact the company’s future profitability. Our profitability for the first half of 2025 was moreover affected by the non-cash expense of the free shares (“IPO share awards”) granted to selected Group executives. For the 12-month period up to June 2025, the Group achieved a 21% Adjusted EBITDA margin, bringing us in line with our IPO guidance of approximately. 20% over the next 18-24 months. We maintained a stable leverage of 0.8x Net Debt (excl. SCI Proceeds) to LTM Adjusted EBITDA, and our cash conversion improved to 50%.

Our May 2025 successful IPO allowed us to become the largest Greek software & tech firm by market cap, as we carried on our strategic vision by growing by 11 major clients, including four foreign banks in 7 countries apart from Greece, established our ICT arm (Quento), securing EU major contracts and acquiring Empedus (100%) and Cenobe (50.1%)

We remain committed to our strategic priorities for organic growth and internationalisation, targeted M&A and tech innovation.

The Group continues to align with our vision for realising long-term shareholder returns and adherence to high standards of transparent corporate governance and sustainability principles.

We look forward to our continued engagement as we build on this strong foundation to create sustained value for all stakeholders.

Financial Results Highlights

Strong Profitability from day one

- Group revenue H1 2024 has increased by +18% YoY, which aligns with IPO guidance of mid-teens growth and is driven mainly by Platforms’ growth, confirming our development strategy.

- Profitability in H1 2025 surpassed H1 2024 and confirms our confidence in delivering mid-teens growth amidst volatile market conditions.

- Adjusted EBITDA H1 2025 at €13m has grown by 31% YoY.

- In terms of net profitability, excluding adjustments, we incurred a loss for the first half of 2025. The negative bottom line is mainly attributable to reorganizational expenses, which include legal and consulting services to transition the mother company from English to Greek jurisdiction and prepare the Group for its successful IPO and rationalisation of the Group’s structure. The amount of these reorganizational expenses was also due to the limited timeframe for this preparation. They are truly non-recurring (one-off) expenses that are now complete and will not impact the company’s future profitability.

- Our profitability for the first half of 2025 was moreover affected by the non-cash expense of the free shares (“IPO share awards”) granted to selected Group executives.

- We outperform H1 2024 in terms of EBITDA margins, and the 21% EBITDA margin for the 12 months is on track with the IPO Medium Term guidance of approximately 20% EBITDA margin within two years post-IPO.

- COGS remain at 56% in line with the historical average

Solid liquidity to withstand any headwind

- Robust Liquidity for organic expansion and M&A: We have improved the current ratio by 0.5x within 6 months.

- Cash position benefits from share capital increase upon successful IPO and ATHEX listing. The net IPO proceeds were €47 million, of which more than €10 million has been allocated to investments already (22% invested within the first two months vs 18 months deadline) and €2 million for working capital improvement again as per IPO plan.

- Cash position, excluding the remaining IPO proceeds at €27 million, still shows vast improvement compared to FY 2024, based on strong H1 2025 profitability and improved cash flow management.

- Cash Flow from Operations increases drastically and paves the way for further improvement of working capital as per the IPO Plan

- Group achieved 50% cash conversion in H1 2025, returning to historical strong cash conversion above 50%.

Prudent leverage management to safeguard our quality

- Modest increase in leverage allows:

- fulfil management’s strategic vision on organic growth

- leave headroom for bolt-on M&A

- Average cost of debt of 4.0% in H1 2025 vs 4.8% in FY 2024.

- Platforms as a Service continues to lead revenue and profitability growth.

Well-balanced business model laying the foundation for internationalisation and rapid expansion

- We have a stable geographical contribution for H1 2025 compared to H1 2024 and FY 2024; we expect the international revenue contribution to increase in the second half.

- Energy & Utilities revenue contribution has decreased below < 50% aligning with the target for increased group diversification.

- The Public sector is a new notable revenue contributor.

Qualco Group credits its strong H1 performance to disciplined execution and strategic leadership. The organisation remains committed to delivering sustainable growth and stakeholder value throughout 2025 and beyond.